As we mentioned in the previous article, the economic situation continues to face challenges. However, the prospects for stabilization are becoming more and more visible. The world economy seems to experience a "soft landing" in 2025, and gradual recovery patterns are being witnessed, particularly in Europe. Nevertheless, the geopolitical tensions and instability may impact these expectations substantially.

According to the World Economic Outlook Report (IMF, 2024), world economic growth is about to stabilize at 3.2%, since inflation is projected to decelerate to 4.5% globally, while developed economies can expect an even lower rate of inflation at 3.1%. The persistent easing of monetary policies, like interest rate cuts in major economies, will be the driving force behind this rebound. Inflation, however, is a big problem, particularly in sectors that are highly dependent on high-energy consumption like the manufacturing of electronics.

Supply chain stability at the end of 2024 was healthier than in previous years, and lead times for most electronic components are back to normal. Still short are semiconductor memory components, however, states the Semiconductor Industry Association (SIA, 2024). Economic stabilization and deflationary pressures, expected to occur, will ease pressure on producers, but cost pressures will still drive production plans and prices.

1. Sustainability and Green Manufacturing

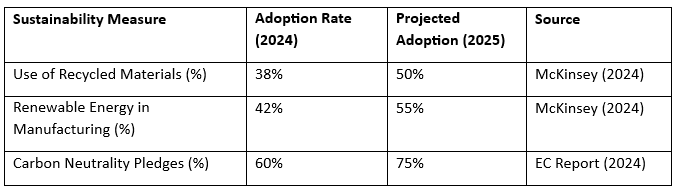

Sustainability remains a priority, with institutions such as the European Commission establishing stricter EcoDesign Regulations (2024) for electronics. McKinsey & Co. (2024) reveals that 72% of electronics producers have invested more in low-carbon manufacturing methods. The shift towards renewable resources and recycled material is evident, with growth projections indicating improved growth till 2025. Those companies that make early investments in sustainable production processes (including sustainable sources of energy) will likely gain the benefit of regulatory favour and customer demand for sustainable products.

Increasing adoption of actions to be more sustainable shows that the industry is responding to regulatory and market forces. Companies that lag behind, may encounter loss of competitiveness as sustainability becomes business-as-usual and a valid means of cost-saving in the environment of rising energy prices.

2. Reshoring and Nearshoring

The geopolitical landscape and recent supply chain disruptions have compelled manufacturers to shift towards regional supply chains. An estimated 40% of electronics manufacturers will have reshored or nearshored production by 2025, according to Gartner (2024). Amid the ongoing and strengthening trade tensions, this trend will likely continue. With the growing tariff concerns and their actual execution, OEMs will more likely target to localise production closer their customer markets. This trend will likely continue within upcoming years.

While localisation will definitely bring back stronger production capabilities to the Western economies, enhancing supply security, it will also place short-term cost burdens as firms establish new plants.

Though there could be an initial cost factor, companies that implement these localisation strategies will have more flexibility, improved supply security, and fewer dependencies on volatile international trade conditions.

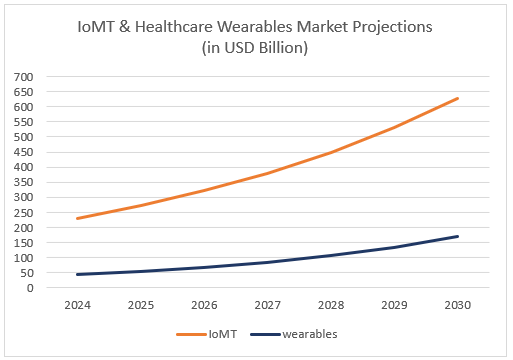

3. IoMT and Medical Wearables

The convergence of wearable health technology and the Internet of Medical Things (IoMT) transforms healthcare with real-time patient monitoring, predictive diagnostics, and personalised treatment plans. Intelligent devices ranging from biosensors and ECG patches to AI-powered smartwatches record and exchange critical health information in real time, speeding up response times and patient outcomes. This transition is driving rapid market expansion: the global IoMT market is projected to grow from $230.69 billion in 2024 to $627.99 billion in 2030, and the wearable tech market will likely grow from $42.74 billion in 2024 to $168.29 billion in 2030, with a CAGR of 25.53%.

This revolution demands precision manufacturing, dependable connectivity solutions, and very stringent medical regulation compliance. With the speed of digitalization in healthcare, EMS providers must deliver high-reliability solutions propelling the digital future for connected medical devices.

*Projections are based on a Compound Annual Growth Rate (CAGR) of 25.53% for Wearable Medical Devices and 18.2% for IoMT from 2025 to 2030.

4. Advanced PCB Assembly

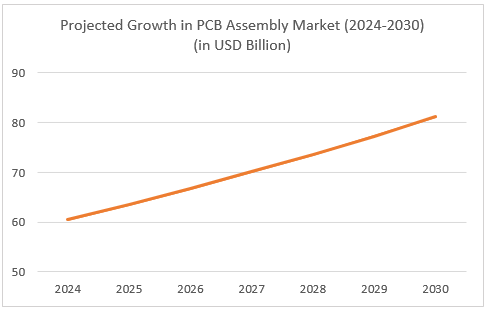

Rapid development of high-performance, miniaturized, and complex electronic products is driving the development of Printed Circuit Board (PCB) assembly technology. Electronics manufacturing services suppliers in 2025 will be adopting next-generation Surface Mount Technology (SMT), inspection equipment, and automation to provide greater efficiency, precision, and reliability. For hassle-free assembly, cutting-edge Automated Optical Inspection (AOI) and Solder Paste Inspection (SPI) are more sought after with breakthroughs in defect inspection and reflow soldering accuracy. These technologies are particularly critical in medical electronics where ultra-miniature PCBs must be assembled into high-reliability devices. EMS providers will be meeting the growing demand for faster, smaller, and more feature-laden electronic products in 2025 and beyond.

*The projection is based on Printed Circuit Board Assembly Market Forecast (2025 – 2031) by IndustryARC™

5. Defence sector

The European Union has initiated a comprehensive defence upgrade program, as indicated by the recently announced "ReArm Europe" plan, with the aim of raising up to €800 billion to boost military capacity. This massive investment is an indication of the EU's resolve to enhance its defence infrastructure in response to shifting global security patterns.

This growth in defence spending gives rise to the demand for specialized electronics manufacturing services (EMS) to fulfill the manufacturing requirements of advanced defence equipment. The defence forces employ high-mix, low-volume series production runs on the whole, which are characteristic of complex and advanced printed circuit board assemblies (PCBAs). These are typically produced in small quantities—single to hundreds—because they are bespoke and feature stringent performance specifications

Besides, it is given top priority that PCBAs used by the military are entirely manufactured in Europe from scratch to the end with minimal reliance on external manufacturing hubs like China. Such a market strategy is being followed to minimize supply chain risks and to attain extremely high quality required for defence applications. Thus, the business of PCB in Europe can anticipate a sharp growth, due to the attainment of locally produced, high-reliability components with mil-spec design requirements.

The trend is likely to carry on for the coming years, in harmony with the EU's strategic defence objectives and continuing transformations in security threats globally.

Final Thoughts

As 2025 unfolds, the electronics manufacturing industry is navigating through a complicated environment characterized by economic turbulences, technological innovation, and shifting supply chain strategies. World economic expansion shall stabilize at 3.2%, and inflation continues to be a watchword. Nevertheless, easing monetary policies and supply chain effectiveness provide prospects for a steady recovery. Sustainability is no longer optional - companies that bet on green processes will gain the reward of regulatory advantages and cost savings in the long run. Those who choose the right manufacturing partners—ones that prioritize innovation, quality, and strategic adaptability will be best positioned to navigate these changes and stay ahead of the competition.