Current Overview and Outlook of the Components Market

The material market conditions within the first months of 2025 have been relatively calm and stable. The horrors of the post-covid era have already been erased by many of the market participants, and the material availability and accessibility have normalised. Lead times and pricing (apart from typical year-to-year increases here and there) have been stable since a few quarters now. However, since a few weeks concerning behaviour in terms of lead times could be observed. This may be a signal of a new trend and a potential period of constraints in access to components.

Economic outlook

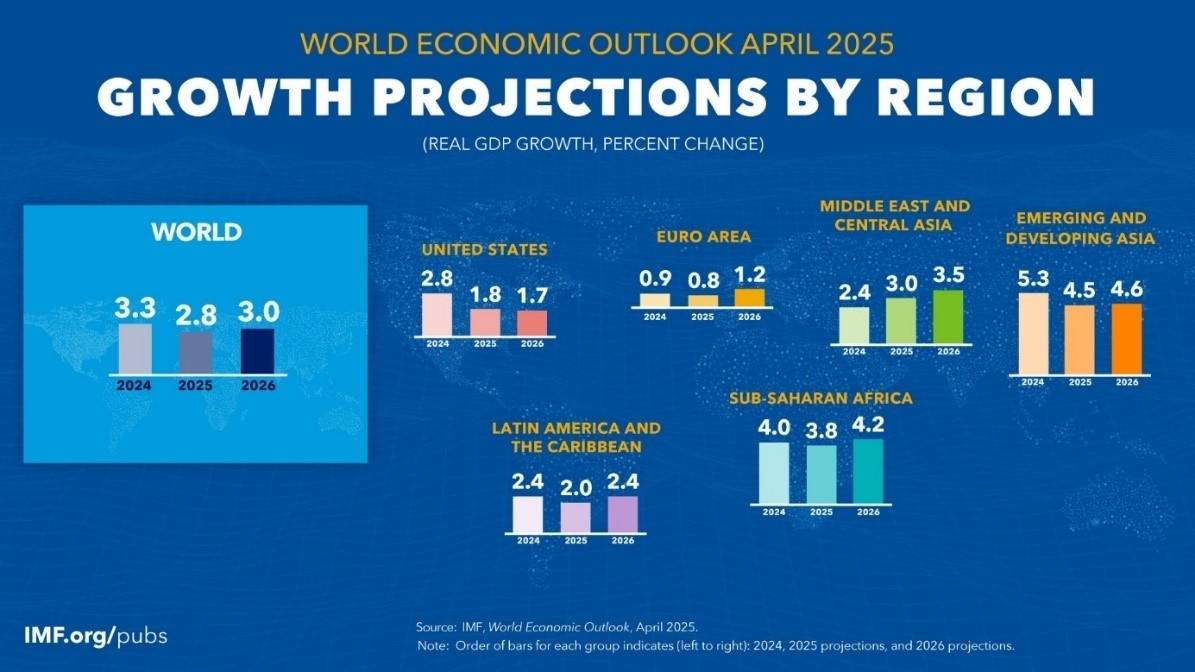

The IMF has revised its economic outlook in April and decreased the expectations concerning both advanced and emerging markets. The main justification behind this downward revision is the implementation of tariffs and a highly unpredictable landscape amid escalating trade tensions.

Depending on the inflation levels, the ECB may further ease the monetary policies. ECB has decreased its rate by 25 basis points in April, and further 25 basis points just a few days ago in June, in an effort to boost the economic growth across the eurozone.

The Trump tariffs are likely to push up price pressures temporarily, and the FED will definitely remain more cautious. Although the Federal Reserve Governor Christopher Waller recently said that interest rate cuts remain possible later this year.

Geopolitical tensions

Amid the global trade tensions, heavily shifted by Donald Trump and the US administration via tariff implementation, we have not seen tangible, negative effects on the supply chain stability caused by the chaos that impacted the financial markets in the short term. This will most probably have a delayed effect, but its severity in the long term may turn out to be high. Chinese export controls and limits on critical and rare earth minerals may be hurtful, as China mines up to 70% of them and controls roughly 90% of the processing capacity. This gives China huge leverage in US-China trade talks. However, if these trade discussions get out of hand, it may strongly impact the supply chain stability. If the export controls by China remain strict, in consequence US may place financial restrictions towards China. It is far too early to state, and the upcoming months shall provide more clarity. The tensions between the two superpowers grow, and the collision track continues. The World Uncertainty Index remains at nearly record heights.

Supply Chain Volatility

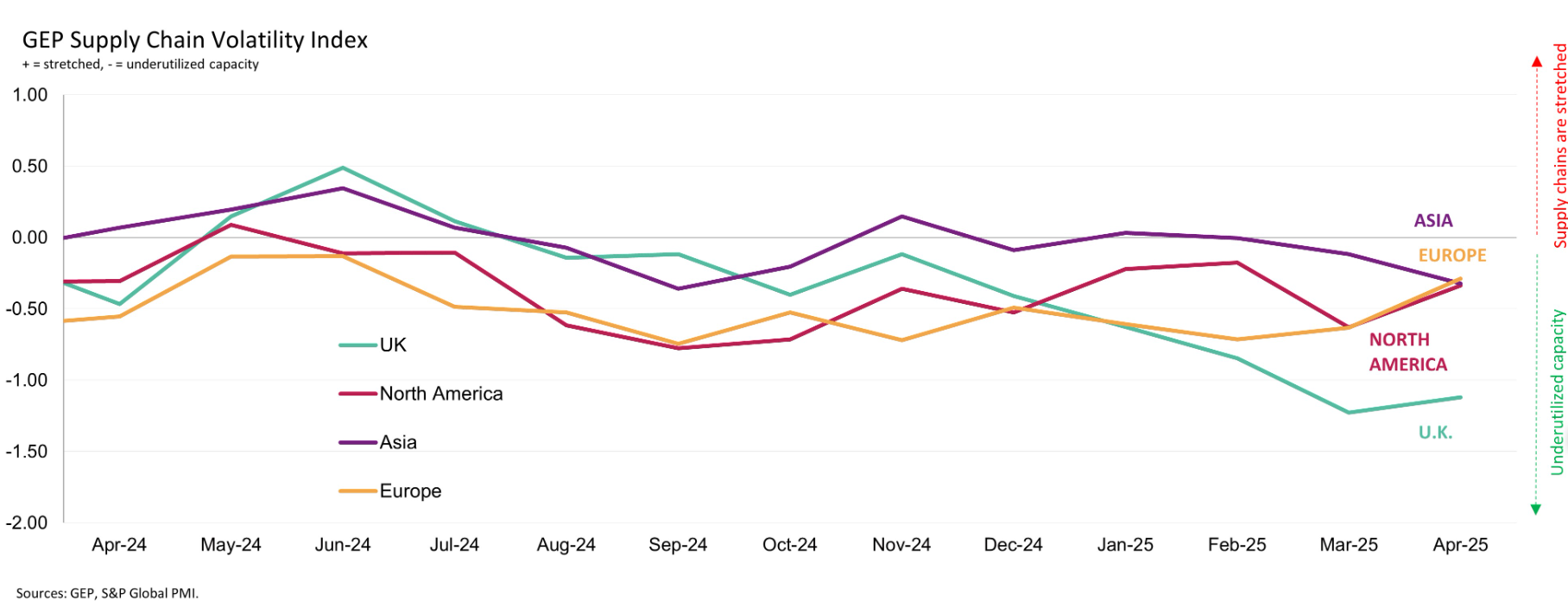

If we look at the GEP Global Supply Chain Volatility Index*, we can observe that globally we are still moving within a slightly underutilised capacity environment, with Europe showing positive signs. Please note that GEP looks at the global supply chains, much broader than just electronics.

Electronics component markets

Supplyframe Commodity IQ highlights that Q1, usually the weakest quarter of all, has observed a significant rise in unseasonal demand for electronics components, which has risen significantly across the Americas and Europe. The root cause is linked to buyers seeking a way to evade potential tariffs. This surge has taken place in a period where electronics stocks are in short supply, hence, these low inventories magnify the impact of demand.

It is also worth to mention that The Semiconductor Industry Association (SIA) announced that the global semiconductor sales in the first quarter of 2025 increased by 18.8% compared to the Q1 of 2024. Nvidia (up 69% in sales year-over-year in Q1), Qualcomm, Broadcom and alike are still in a growth rally as demand continues, which may have an impact on lead times for semiconductors if the trend goes on.

CEO and founder of SupplyFrame states: “With demand rising and availability low, buyers could face challenges sourcing some parts. Under these conditions, buyers need to closely track demand and pricing conditions and be prepared to react quickly to further unexpected developments”

In conclusion, we believe that we are seeing the following phenomenon: with high levels of inventory and decreased sales levels in late 2023/early 2024, all material market players have predominantly focused on seeking cost savings. Shifting to new, more cost-efficient technologies was one way to accumulate savings, but the predominant method to achieve this was via reducing staff and decreasing production output. With the inventory levels being high at the distribution (and at the manufacturers), the lead times have strongly decreased due to the general availability of the materials. As time passed, these inventories have been declining and have dropped to low levels. Such, faced with decreased production capacity and a higher spike in demand linked to tariffs and uncertainty (and magnified by low inventories), is causing signs of turbulence, or more precisely, a deviation from what we have observed in the recent months.

Our suppliers indeed did report a reduction in capacity at selected manufacturers, related to the search for cost optimization and due to lower demand for components after the post-pandemic boom. With depleted inventory, it is becoming more noticeable and translates into signals of delays in the execution of purchase orders.

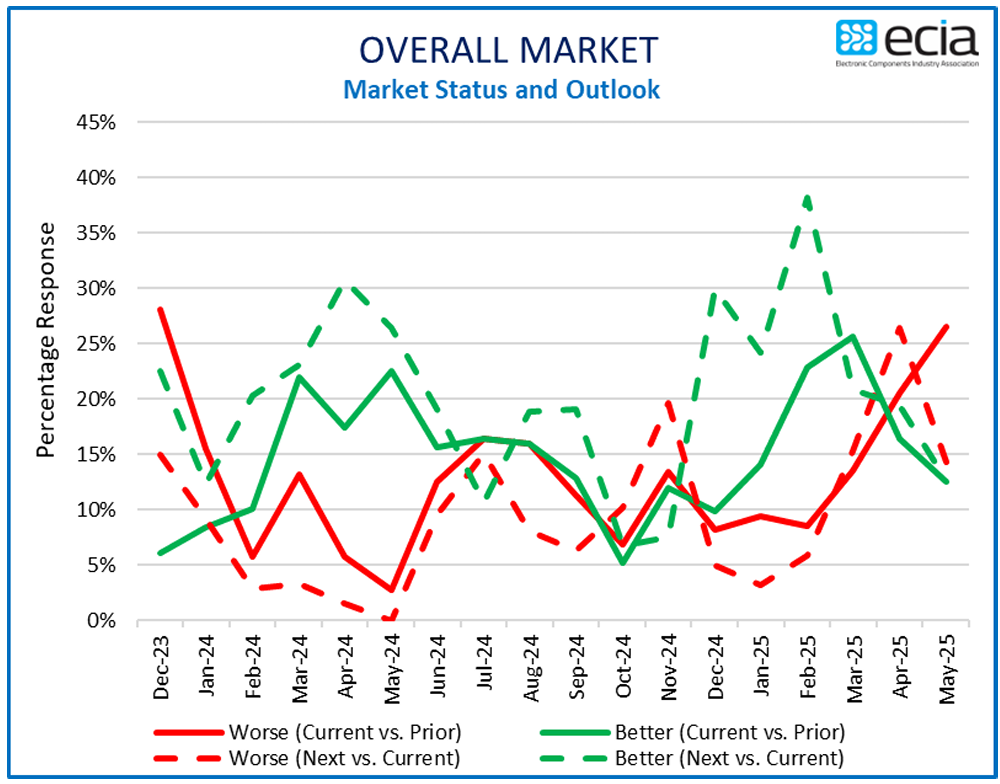

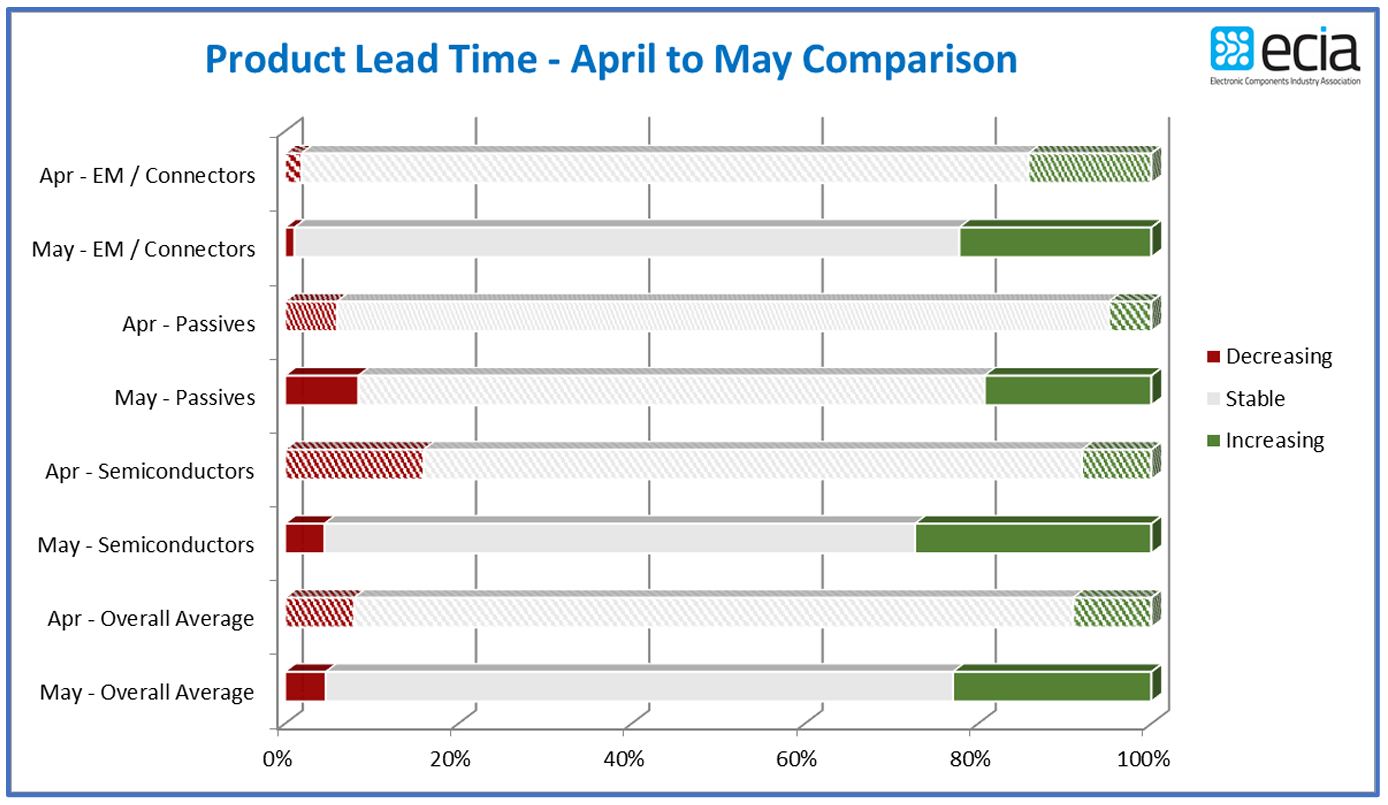

The ECIA Electronic Component Sales Trends from May states: “The lead time scores have been a picture of stability in recent months with almost non-existent reports of decreasing or increasing lead times. That all changed with the May survey as the share of survey participants reporting increasing lead times jumped from 9% in April to 23% overall in May”.

ECIA’s survey results resemble very much our recent observations, regardless if the root cause is tariff-linked or not. From the manufacturer's perspective, it is very much reasonable to have a longer visibility (4-6 months) for production planning purposes, hence, decreasing inventories in time would anyway cause the lead times to increase to some extent sooner or later.

High levels of uncertainty and circumstances changing rapidly may cause irrational behaviours. With lessons learned from the pandemic, it is much too early to react with panic. We would refrain from acting emotionally, as we believe we are nowhere near stating that we are moving to any form of allocation.

Commodity prices

Due to the rising global uncertainty, more volatility in the commodity prices is to be observed.

• Brent Crude Oil pricing is at over $61.5 per barrel, which is the lowest level since mid-2021.

• Gold remains at its record highs, currently at over 3350 USD

• Silver, similarly to gold, is in a rising trend and remains at its heights.

• After a decrease in Q4 of 2024, Copper pricing some been increasing since the beginning of 2025 and is now back to the levels observed in October last year.

PCB’s

Gold and silver may have a negative impact on the PCB prices (depending on the finish), and price increases due to such circumstances have already been seen. It is also expected that the rising copper price may influence the costs of the manufacturers. On the other hand, lower oil prices shall positively impact the shipping costs, which are commonly price-included for that specific commodity. The availability and lead times are stable and good. No deviations have been observed in the last months.

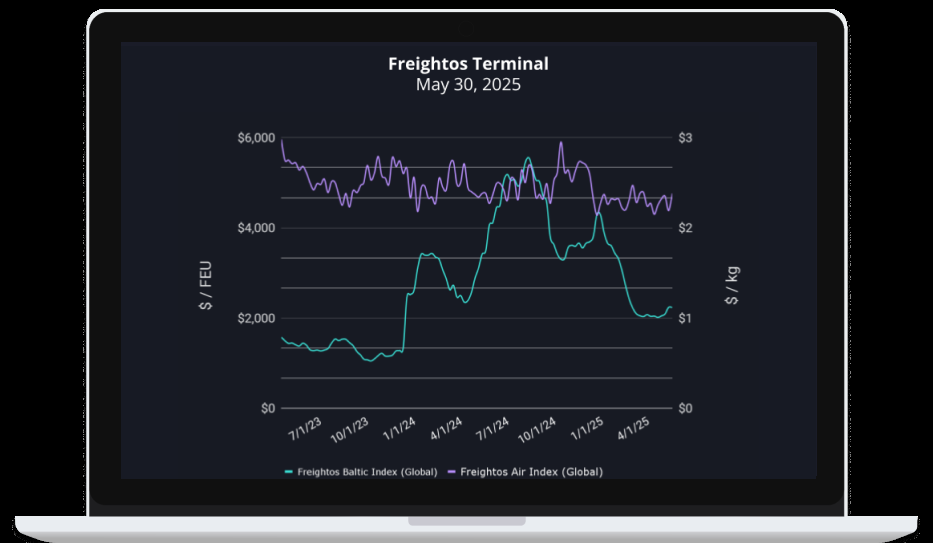

Freight

The global air and container pricing trends remain stable, as based on the Freightos Balic Index (FBX). The oil price shall have a positive impact on freight in the mid-term.

General outlook for H2 2025

The rising geopolitical tensions, growing concerns of trade wars following Trump's tariff plans, as well as no visibility of ending the war in Ukraine, lead us to believe that the levels of uncertainty shall remain high and potentially grow in time. This provides a large dose of ambiguity and difficulty in prediction. Such, of course, may or may not lead to supply chain constraints. At the moment, the biggest concern is mainly related to increased lead times, but in reality, this could also be just a seasonal effect of Trump’s tariff shock.

In summary, despite relative stability in the components market during the first half of 2025, rising geopolitical tensions, economic uncertainty, and early signals of extended lead times suggest a potential period of supply chain disruption. These changes are not yet widespread but warrant close monitoring and caution in planning. In the coming months, the ability to respond quickly to evolving market conditions will be essential, particularly regarding component availability and pricing pressures driven by rising raw material costs and potential tariff adjustments.